Payment of Filing Fee (Check the appropriate box): | | | þ | | No fee required. | | ¨ | o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | | (1 | ) | | Title of each class of securities to which transaction applies: |

| | (2) | | (2 | ) | | Aggregate number of securities to which transaction applies: |

| | (3) | | (3 | ) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | (4 | ) | | Proposed maximum aggregate value of transaction: |

| ¨ | | o | Fee paid previously with preliminary materials. | | ¨ | o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1 | ) | | Amount Previously Paid: | (1) | Amount Previously Paid: |

| (2 | | ) | (2) | Form, Schedule or Registration Statement No.: |

Notice of 2013 Annual Meeting of Stockholders and Proxy Statement

Wednesday, October 16, 2013 at 10:00 a.m. Eastern Time

The Strong, One Manhattan Square, Rochester, NY, 14607

NOTICE OF 2013 ANNUAL MEETING OF STOCKHOLDERS August 31, 2011

Wednesday, October 16, 2013 Dear Paychex Stockholder:10:00 a.m. Eastern Time*

The Strong, One Manhattan Square, Rochester, NY, 14607 *A continental breakfast will be available from 9:00 a.m. - 10:00 a.m. Eastern Time The Boardprincipal business of Directors cordially invites you to attend ourthe 2013 Annual Meeting of Stockholders (the “Annual Meeting”) on Tuesday, October 11, 2011 at 10:00 a.m. Eastern Time at The Strong, One Manhattan Square, Rochester, NY, 14607.Please note this is a change in venue from the prior year.will be: This booklet includes the formal Notice of Annual Meeting of Stockholders and the Proxy Statement. The Proxy Statement tells you about the agenda items and the procedures for the Annual Meeting. It also provides certain information about Paychex, Inc., its Board of Directors, and its named executive officers.

It is important that your shares be represented at the Annual Meeting. Whether or not you plan to attend the Annual Meeting, you are encouraged to vote. You may vote by Internet, telephone, proxy card, or written ballot at the Annual Meeting. We encourage you to use the Internet as it is the most cost-effective way to vote. If you elected to electronically access the Proxy Statement and Annual Report, you will not be receiving a proxy card and must vote via the Internet.

We hope you will be able to attend the Annual Meeting and would like to take this opportunity to remind you that your vote is important. If you need special assistance at the Annual Meeting, please contact the Corporate Secretary at(800) 828-4411, or write to Paychex, Inc., 911 Panorama Trail South, Rochester, New York14625-2396, Attention: Corporate Secretary.

Sincerely,

Martin Mucci

President and Chief Executive Officer

PAYCHEX, INC.

911 Panorama Trail South • Rochester, New York14625-2396

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

| | | Date and Time:1. | | 10:00 a.m. Eastern Time on Tuesday, October 11, 2011. Continental breakfast will be available from 9:00 a.m. to 10:00 a.m. | | Location: | | The Strong, One Manhattan Square, Rochester, NY, 14607. | | Items of Business: | | (1) To elect nine nominees to the Board of Directors for one-year terms;a term of one-year; | | | 2. | | (2) To hold an advisory vote onto approve named executive officer compensation; | | | 3. | | (3) To hold an advisory vote on the frequency of future advisory votes on executive compensation; | | | | (4) To ratify the selection of the independent registered public accounting firm; and | | | 4. | | (5) To transact such other business as may properly come before the Annual Meeting,meeting, or any adjournment thereof. | | Record Date: | | Stockholders of record as of the close of business on August 12, 2011, are entitled to notice of, and to vote at, the Annual Meeting. | | Voting: | | Whether or not you plan to attend the Annual Meeting, it is important that your shares be represented and voted at the Annual Meeting. You may vote either by signing and returning the enclosed proxy card, via the Internet, by telephone, or by written ballot at the Annual Meeting as more fully described in the Proxy Statement. | | Annual Meeting Webcast: | | The Annual Meeting will be simultaneously broadcast over the Internet at 10:00 a.m. Eastern Time on October 11, 2011. Please note that you will not be able to vote or ask questions through the webcast. It can be accessed at the Investor Relations page atwww.paychex.com, and will be archived and available for replay for approximately one month. | | | | August 31, 2011

By Order of the Board of Directors

Stephanie L. Schaeffer

Corporate Secretary |

IMPORTANT NOTICE REGARDING THE AVAILIBILITY OF PROXY MATERIALS FOR THE 2011 ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON OCTOBER 11, 2011Stockholders are cordially invited to attend the Annual Meeting. Stockholders of record at the close of business on August 19, 2013, will be entitled to notice of and to vote at the Annual Meeting and at any adjournments or postponements thereof.

If you are unable to attend the Annual Meeting, you will be able to listen to the meeting via the Internet. We will broadcast the Annual Meeting as a live webcast through our website. Please note that you will not be able to vote or ask questions through the webcast. The webcast will be accessible at http://investor.paychex.com/webcasts and will remain available for replay for approximately one month following the meeting.

By Order of the Board of Directors Stephanie L. Schaeffer Corporate Secretary September 10, 2013

Important notice regarding the availability of proxy materials for the 2013 Annual Meeting of Stockholders to be held on October 16, 2013:

Paychex, Inc.’s Proxy Statement and Annual Report for the year ended May 31, 20112013 are available at

http://investor.paychex.com/annual.aspxannual-report.aspx.

Welcome to the Paychex, Inc. 2013 Annual Meeting of Stockholders TABLE OF CONTENTS

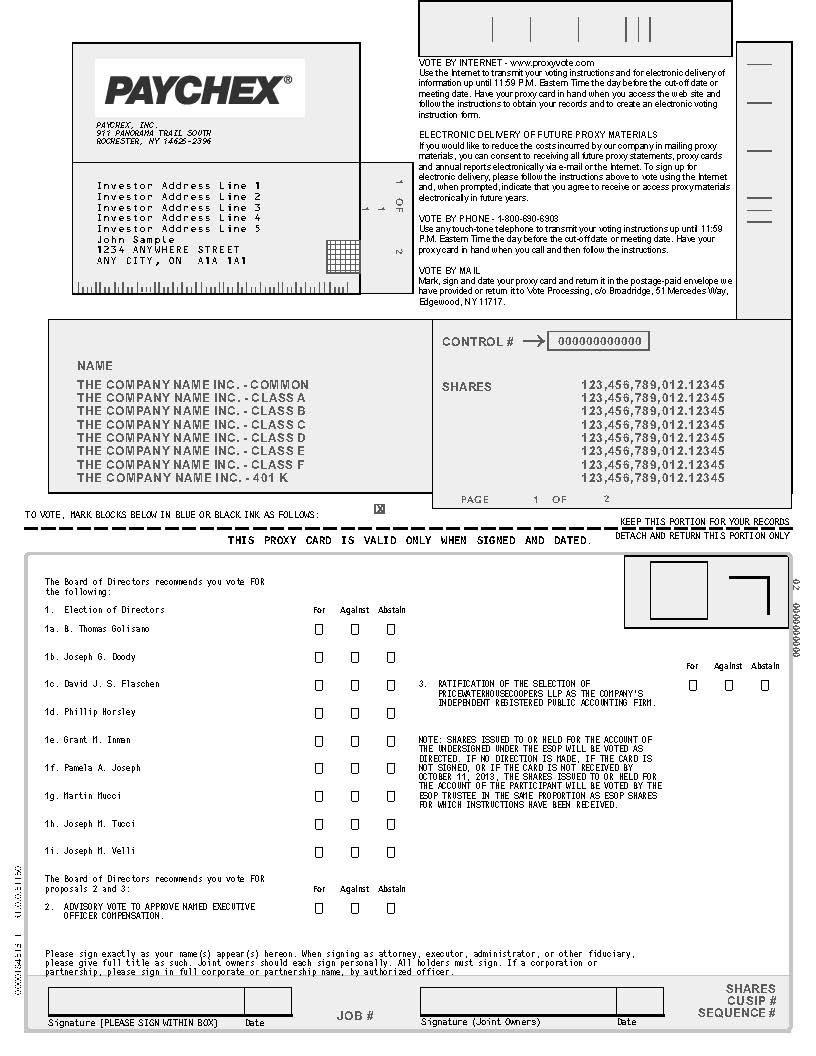

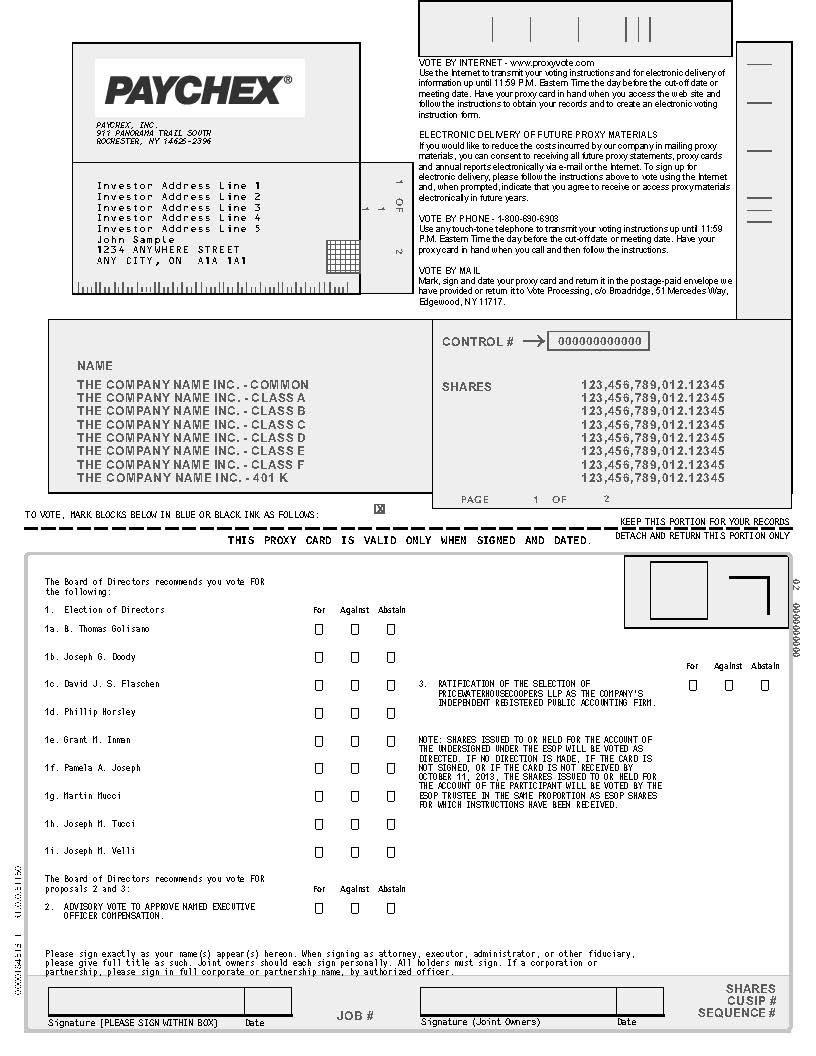

Proposals That Require Your Vote | | | | | | | | More Information in Proxy Statement | Board Recommendation | Proposal 1 | Election of directors for a one-year term | Page 6 | FOR all nominees | Proposal 2 | Advisory vote to approve named executive officer compensation | Page 18 | FOR | Proposal 3 | Ratification of selection of Independent Registered Public Accounting Firm | Page 50 | FOR |

Who Can Vote August 19, 2013 is the record date fixed by the Board of Directors. Stockholders of record as of that date are entitled to notice of and to vote at the 2013 Annual Meeting of Stockholders. How to Vote In Advance of the Meeting Your vote is very important and we hope that you will attend the Annual Meeting. Even if you plan to attend the Annual Meeting in person, we recommend that you vote right away using one of the following advance voting methods. Make sure to have your proxy card or voting instruction card in hand and follow the instructions.

You can vote in advance, in one of three ways: | | | | | | Visit the website listed on your proxy card to vote VIA THE INTERNET; | | | | | Call the telephone number on your proxy card to vote BY TELEPHONE; or | | | | | | | Sign, date, and return your proxy card in the enclosed envelope to vote BY MAIL. |

Voting at our 2013 Annual Meeting of Stockholders All stockholders of record may vote in person at the Annual Meeting, which will be held on Wednesday, October 16, 2013 at 10:00 a.m. Eastern Time at The Strong in Rochester, New York. Beneficial owners, whose shares are held by a bank, broker, or other holder of record, must obtain a legal proxy in order to vote in person at the Annual Meeting.

TABLE OF CONTENTS | | | | | General Information | 1 |

| | Beneficial Ownership of Paychex Common Stock | 4 |

| | | | 4 | | | | | | | | | | 6 |

| | | | | | | | 2013 | 9 |

| | Corporate Governance | 12 |

| | Board Leadership Structure | 12 |

| | Risk Oversight | 12 |

| | Board Meetings and Committees | 13 |

| | Nomination Process | 15 |

| | Policy on Transactions with Related Persons | 15 |

| | Governance and Compensation Committee Interlocks and Insider Participation | 16 |

| | Communications with the Board of Directors | 16 |

| | Section 16(a) Beneficial Ownership Reporting Compliance | 17 |

| | Code of Business Ethics and Conduct | 17 |

| | 18 |

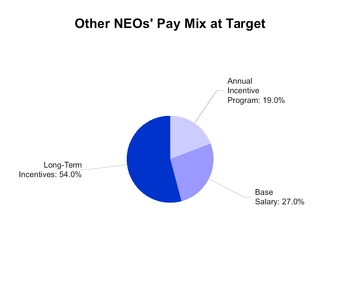

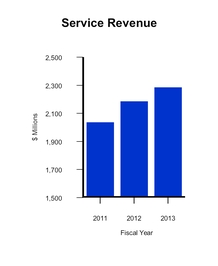

| | Compensation Discussion and Analysis | 919 |

| | Executive Summary | 19 |

| | Objectives of Compensation Program | 24 |

| | Elements of Compensation | 24 |

| | Compensation Decision Process | 30 |

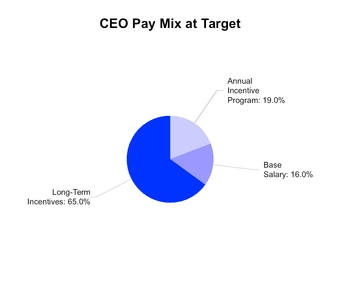

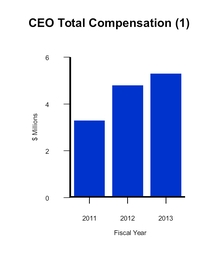

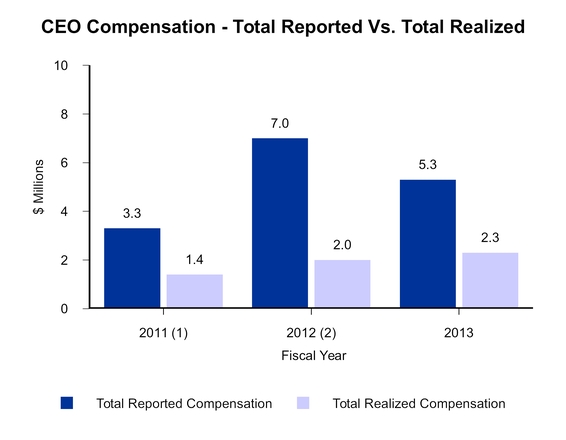

| | CEO Compensation | 33 |

| | Subsequent Events | 33 |

| | Impact of the Internal Revenue Code | 33 |

| | The Governance and Compensation Committee Report | 34 |

| | Named Executive Officer Compensation | 35 |

| | Fiscal 2013 Summary Compensation Table | 35 |

| | Grants of Plan-Based Awards For Fiscal 2013 | 38 |

| | Option Exercises and Stock Vested In Fiscal 2013 | 40 |

| | Outstanding Equity Awards as of May 31, 2013 | 41 |

| | Potential Payments upon Termination or Change In Control Fiscal 2013 | 45 |

| | Non-Qualified Deferred Compensation Fiscal 2013 | 48 |

| | | | 10 | | | | | 10 | | | | | 11 | | | | | 11 | | | | | 12 | | | | | | | | | | 13 | | | | | | | | | | 14 | | | | | | | | 50 | | 14 |

| | 51 | | 15 |

| | | | 15 | | | 52 | | 16 |

| | | | | | | | | 17 | | | | | 17 | | | | | 17 | | | | | 18 | | | | | 19 | | | | | 19 | | | | | 20 | | | | | 20 | | | | | | | | | | 21 | | | | | 21 | | | | | | | | | | 22 | | | | | 22 | | | | | 24 | | | | | 24 | | | | | 25 | | | | | 27 | | | | | 27 | | | | | 28 | | | | | 29 | | | | | 29 | | | | | 29 | | | | | 30 | | | | | 30 | | | | | 30 | | | | | 30 | | | | | 31 | | | | | 31 | | | | | 31 | | | | | | | | | | 32 | | | | | 32 | | | | | 34 | | | | | 35 | | | | | 36 | | | | | 38 | | | | | 41 | | | | | | | | 53 |

| | Appendix A: Paychex, Inc. Reconciliation of Performance Measures to Those Reported in the Company's Consolidated Financial Statements | 42A-1 |

| | Appendix B: Paychex, Inc. Peer Group | B-1 |

|

PROXY STATEMENT

Paychex, Inc. 911 Panorama Trail South 2011 ANNUAL MEETING OF STOCKHOLDERS OF PAYCHEX, INC.

TO BE HELD ON OCTOBER 11, 2011Rochester, NY 14625

This Proxy Statement is being mailed to stockholders of GENERAL INFORMATION

Paychex, Inc. (“Paychex,” the “Company,” “we,” or “our”)“our ”), a Delaware corporation, on or about August 31, 2011,is furnishing this Proxy Statement to stockholders in connection with the solicitation of proxies byon behalf of the Board of Directors of the Company (the “Board”) to be voted atfor the 20112013 Annual Meeting of Stockholders (the “Annual Meeting”). This Proxy Statement summarizes information concerning the matters to be presented at the Annual Meeting and related information to help stockholders make an informed vote. Distribution of this Proxy Statement and a proxy form to stockholders is scheduled to begin on or about September 10, 2013. 2013 Annual Meeting of Stockholders The Annual Meeting will be held on Tuesday,Wednesday, October 11, 201116, 2013 at 10:00 a.m. Eastern Time at The Strong, One Manhattan Square, Rochester, NY, 14607. 14607. Proposals Subject to Vote The table below shows the proposals subject to vote at the Annual Meeting, along with information on what vote is required to approve each of the proposals, assuming the presence of a quorum at the Annual Meeting, and the Board's recommendations for each proposal. With respect to Proposals 1, 2, and 3, you may vote “FOR,” “AGAINST,” or “ABSTAIN.” | | | | | | | Proposal | | Vote Required | | Board Recommendation | | Proposal 1: Election of nine nominees to the Board of Directors | | Majority of the votes duly cast | | FOR all nominees | | Proposal 2: Advisory approval of the Company’s named executive officer compensation | | Majority of the shares present in person or by proxy and entitled to vote | | FOR | | Proposal 3: Ratification of the selection of the Independent Registered Public Accounting Firm | | Majority of the shares present in person or by proxy and entitled to vote | | FOR |

Stockholders Entitled to Vote;Vote and Outstanding Shares; QuorumShares Stockholders of shares outstanding, designatedrecord of our common stock $0.01 par value per share. The Board has fixedas of the close of business on August 12, 2011 as the record date for determining the holders of common stock entitled to notice of, and19, 2013 (the "Record Date") will be eligible to vote at the Annual Meeting. Each share outstanding as of the Record Date will be entitled to one vote. As of the record date, 362,685,721August 19, 2013, 365,487,312 shares of common stock were issued and outstanding. AThe holders of a majority of the issued and outstanding shares (181,342,862entitled to vote (182,743,657 shares) must be present at the Annual Meeting in person or by proxy willin order to constitute a quorum. A quorum is necessary to hold a valid meeting. Stockholders will be entitled to one vote for each share of common stock held as of the record date.

How to Vote Your vote is very important and we hope that you will attend the Annual Meeting. However, whether or not you plan to attendWe strongly urge all stockholders, even those attending the Annual Meeting, pleaseto vote by proxy.proxy prior to the Annual Meeting. Registered Stockholders Registered Stockholders.If your shares are registered directly in your name with the Company’s transfer agent, American Stock Transfer & Trust Company, LLC, you are considered a stockholder of record ofwith respect to those shares. Please vote by proxy in accordance with the instructions on your proxy card, or the instructions you receive through electronic mail.

A registered shareholder can vote in one of four ways: There are three convenient waysVia the Internet — Go to submitthe website noted on your proxy card in order to vote via the Internet. Internet voting is available 24 hours a day. We encourage you to vote via the Internet, as it is the most cost-effective way to vote. By telephone — Call the toll-free telephone number indicated on your proxy card and follow the voice prompt instructions to vote by proxy:telephone. Telephone voting is available 24 hours a day. By mail — Mark your proxy card, sign and date it, and return it in the enclosed postage-paid envelope. If you elected to electronically access the Proxy Statement and Annual Report, you will not receive a proxy card and must vote via the Internet. | | | | • | Voting by Internet— You can vote via the Internet by visiting the website noted on your proxy card. Internet voting is available 24 hours a day. We encourage you to vote via the Internet, as it is the most cost-effective way to vote. | | | • | Voting by telephone— You can also vote your shares by telephone by calling the toll-free telephone number indicated on your proxy card and following the voice prompt instructions. Telephone voting is available 24 hours a day. | | | • | Voting by mail— If you choose to vote by mail, simply mark your proxy card, sign and date it, and return it in the enclosed postage-paid envelope. If you elected to electronically access the Proxy Statement and Annual Report, you will not be receiving a proxy card and must vote via the Internet. |

The deadline forIn person — You may vote your shares at the Annual Meeting if you attend in person, even if you previously submitted a proxy card or voted via Internet or telephone. Whether or not you plan to attend the Annual Meeting, however, we strongly encourage you to vote your shares by proxy before the meeting. Proxies submitted by Internet or telephone voting ismust be received by 11:59 p.m. Eastern Time on Monday, Tuesday, October 10, 2011.15, 2013. If you vote by telephone or the Internet, you do not need to return your proxy card. Signing and returning your proxy card or submitting your proxy via the Internet or by telephone does not affect your right to vote in person if you attend the Annual Meeting and Beneficial Stockholders If your shares are registeredheld in a brokerage account in the name of your name. Beneficial Stockholders. If you hold your shares through abank, broker, bank, or other holder of record (this is called “street name”), you are not a registered stockholder, but rather are considered a “beneficial owner” of those shares. In order to vote your shares, please refer to the voting instruction form or other materials forwarded to you by yourYour bank, broker, bank, or other holder of record.record will send you instructions on how to vote your shares. If your sharesyou are held in the name of a broker, bank, or other holder of record,beneficial owner, you must obtain a proxy, executed in your favor, from the holder of record to be able to vote in person at the Annual Meeting.

Voting by Participants in the Paychex Employee Stock Ownership Plan Stock Fund.Fund

If a stockholder isyou are a participant in the Paychex Employee Stock Ownership Plan Stock Fund (“ESOP”) of the Paychex, Inc. 401(k) Incentive Retirement Plan (the “401(k) Plan”), the stockholderyou will receive a proxy card and can vote those shares using the methods previously described methods.under Registered Stockholders. This will serve as a voting instruction for Fidelity Management Trust Company (the “Trustee”), where all accounts are

1

registeredwho is the holder of record for the shares in the same name.ESOP. As a participant in the ESOP, the stockholder hasyou have the right to direct the Trustee who is the holder of record, regardingon how to vote the shares of common stock credited to the participant’syour account at the Annual Meeting. The participant’sparticipants’ voting instructions will be tabulated confidentially. Only the Trusteeand/or the tabulator will have access to theeach participant’s individual voting direction. If you do not submit voting instructions for theyour shares of common stock in the ESOP, are not received, those shares will be voted by the Trustee in the same proportions as the shares for which voting instructions were received from other participants in the ESOP.participants. Voting instructions by ESOP participants will close atmust be received by 11:59 p.m. Eastern Time on Friday, October 6, 2011.11, 2013. The Trustee will then vote all shares of common stock held in the ESOP by the established deadline.

Changing or Revoking Your Proxy Registered stockholders can revoke theirmay change a properly executed proxy at any time prior to it being voted at the Annual Meeting by: providing written notice of revocation to the Corporate Secretary; | | | | • | providing written notice of revocation to the Corporate Secretary; | | | • | submitting a later-dated proxy via the Internet, telephone, or mail; or | | | • | submitting a later-dated proxy via the Internet, telephone, or mail; or voting in person at the Annual Meeting. |

Beneficial stockholders should contact their broker, bank, or other holder of record for instructions on how to change their vote. If you are a participant in the ESOP, you may change a properly executed proxy at any time prior to 11:59 p.m. Eastern Time on October 11, 2013, by submitting a proxy that has a more recent date than the original proxy by internet, telephone, or mail. You may not, however, change your voting instructions in person at the Annual Meeting because the Trustee will not be present. General Information onManner for Voting Proxies

All votes properly cast and not revoked will be voted at the Annual Meeting in accordance with the stockholder’s directions. Shares voted byYou should specify your choice for each matter on your proxy card. However, if you do not specify your choices on your returned proxy card, received without choices specifiedthen your shares will be voted in accordance with the Board's recommendations. Should any matter not described above be properly presented at the Annual Meeting, the persons named on the proxy form will vote in accordance with their judgment as follows: | | | | • | FORthe nine nominees for election to the Board; | | | • | FORthe executive compensation program(“say-on-pay” vote); | | | • | FORa frequency ofevery yearfor advisory votes on executive compensation; and | | | • | FORthe ratification of the selection of the independent registered public accounting firm (the “independent accountants”). |

permitted. If you are a broker holdsbeneficial owner, in order to ensure your shares in its name, andare voted the way you would like, you must provide voting instructions to your bank, broker, or other holder of record. If you do not provide your voting instructions to them, that party, whether your shares can be voted depends on the type of item being considered for vote. New York Stock Exchange ("NYSE") rules allow your bank, broker, is permittedor other holder of record to use its own discretion and vote your shares on routine matters. However, aA bank, broker, or other holder of record does not have discretion to vote your shares on non-routine matters (“broker(known as “broker non-votes”). Proposals 1 and 2 are not considered to be routine matters under the current NYSE rules, and so your bank, broker, or other holder of record will not have the discretionary authority to vote your shares on those items. Proposal 3 is considered a routine matter under NYSE rules, so your bank, broker, or other holder of record will have discretionary authority to vote your shares on that item. Broker non-votes are not considered votes for or against a proposal and therefore will have no direct impact on any proposal since they are not deemed to be duly cast nor entitled to vote, but they will be counted for the purpose of determining the presence or absence of a quorum.Therefore, we urge you to give voting instructions to your bank or broker on all voting items. Abstentions are also counted for the purposes of establishing a quorum, but will have the same effect as a vote against a proposal, except in regards to the election of directors and the frequency of advisory votes on executive compensation.directors. For these two items,this item, abstentions will have no direct impact.

2

Announcement of Voting Results The table below showsWe will announce the vote required to approve each of the proposals described in this Proxy Statement, assuming the presence of a quorumpreliminary voting results at the Annual Meeting. With respect to Proposals 1, 2, and 4, you may vote “FOR,” “AGAINST,” or “ABSTAIN.” With respect to Proposal 3, you may vote forThe Company will report the final results in a frequency of “ONE YEAR,” “TWO YEARS,” or “THREE YEARS,” or you may “ABSTAIN.”

| | | | | Proposal Number

| | Proposal Description

| | Vote Required

| | Proposal 1 | | Election of nine nominees to the Board of Directors | | Majority of the votes duly cast | Proposal 2 | | An advisory vote on executive compensation | | Majority of the shares present in person or by proxy and entitled to vote | Proposal 3 | | An advisory vote on the frequency of future advisory votes on executive compensation | | Frequency receiving majority of the votes duly cast | Proposal 4 | | Ratification of the selection of the independent accountants | | Majority of the shares present in person or by proxy and entitled to vote |

3

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth information, based upon reportsCurrent Report on Form 8-K filed by such persons with the Securities and Exchange Commission (“SEC”("SEC"),.

BENEFICIAL OWNERSHIP OF PAYCHEX COMMON STOCK

The following table contains information, as of July 31, 2011, with respect to2013, on the beneficial ownership of the Company's common stock by:

each principal stockholder known to be a beneficial owner of more than 5% of the Company by: (i)Company's common stock. This includes any person (including any “group”"group" as that term is used in Section 13(d)(3) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”)) who is known by the Company to be the beneficial owner of more than 5% of the Company’s voting securities; (ii) amended; each director and nominee for director of the Company; (iii) director; each of the Company's named executive officers (“NEO”s) of the Company named in the Fiscal 2011 Summary Compensation Table;("NEOs"); and (iv) all directors, NEOs, and executive officers of the Company as a group. | | | | | | | | | | | | | Amount of Beneficial

| | | | | | Ownership of

| | Percent of

| Name | | Common Stock(1) | | Class(1) | | | More than 5% owners: | | | | | | | | | B. Thomas Golisano(2),(3),(4) | | | 37,958,637 | | | | 10.4 | % | | 1 Fishers Road | | | | | | | | | | Pittsford, NY 14534 | | | | | | | | | | | | | | | | | | | Capital World Investors(5) | | | 29,638,718 | | | | 8.2 | % | | 333 South Hope Street | | | | | | | | | | Los Angeles, CA 90071 | | | | | | | | | | | | | | | | | | | Directors: | | | | | | | | | B. Thomas Golisano(2),(3),(4) | | | 37,958,637 | | | | 10.4 | % | Joseph G. Doody(6) | | | 5,094 | | | | ** | | David J. S. Flaschen(6),(7) | | | 83,779 | | | | ** | | Phillip Horsley(6),(7) | | | 148,736 | | | | ** | | Grant M. Inman(4),(6),(7) | | | 246,920 | | | | ** | | Pamela A. Joseph(6),(7) | | | 37,471 | | | | ** | | Martin Mucci(6),(7) | | | 304,886 | | | | ** | | Joseph M. Tucci(6),(7) | | | 69,971 | | | | ** | | Joseph M. Velli(6),(7) | | | 36,304 | | | | ** | | | | | | | | | | | | Named Executive Officers: | | | | | | | | | Martin Mucci(6),(7) | | | 304,886 | | | | ** | | John M. Morphy(6),(7) | | | 254,950 | | | | ** | | Michael E. Gioja(6),(7) | | | 31,087 | | | | ** | | William G. Kuchta(6),(7) | | | 145,813 | | | | ** | | Michael A. McCarthy(6),(7),(8) | | | 92,182 | | | | ** | | Jonathan J. Judge(9) | | | 55,004 | | | | ** | | Delbert M. Humenik(10) | | | 813 | | | | ** | | | | | | | | | | | | All directors, NEOs, and executive officers of the Company as a group (18 persons)(6),(7) | | | 39,504,539 | | | | 10.9 | % |

| | | ** | | Indicated percentage is less than 1%. | | (1) | | Based upon the number of shares of common stock issued and outstanding as of July 31, 2011. Under the rules of the SEC, “beneficial ownership” is deemed to include shares for which the individual, directly or indirectly, has or shares voting or disposition power, whether or not they are held for the individual’s benefit, and includes shares that may be acquired within 60 days by exercise of options. This information is based upon reports filed by such persons with the SEC. | | | | | | | | | | | | | | | | | | Name | | Amount of Shares Owned (1) | | Non-vested Shares of Restricted Stock (2) | | Stock Options Exercisable by September 29, 2013 (3) | | Total Shares Beneficially Owned | | Percent of Class | | Principal Shareholders: | | | | | | | | | | | B. Thomas Golisano (4),(5),(6) 1 Fishers Road Pittsford, NY 14534 | | 37,935,821 |

| | — |

| | — |

| | 37,935,821 |

| | 10.4 | % | FMR LLC (7) 245 Summer Street

Boston, MA 02109 | | 23,106,591 |

| | — |

| | — |

| | 23,106,591 |

| | 6.3 | % | Capital World Investors (8) 333 South Hope Street Los Angeles, CA 90071 | | 19,330,182 |

| | — |

| | — |

| | 19,330,182 |

| | 5.3 | % | | Directors: | | | | | | | |

|

| | | B. Thomas Golisano (4),(5),(6) | | 37,935,821 |

| | — |

| | — |

| | 37,935,821 |

| | 10.4 | % | | Joseph G. Doody | | 7,926 |

| | 1,564 |

| | 32,285 |

| | 41,775 |

| | ** |

| | David J. S. Flaschen | | 31,531 |

| | 1,564 |

| | 78,706 |

| | 111,801 |

| | ** |

| | Phillip Horsley | | 103,484 |

| | 1,564 |

| | 26,520 |

| | 131,568 |

| | ** |

| Grant M. Inman (6) | | 190,746 |

| | 1,564 |

| | 78,706 |

| | 271,016 |

| | ** |

| | Pamela A. Joseph | | 14,324 |

| | 1,564 |

| | 58,706 |

| | 74,594 |

| | ** |

| | Martin Mucci | | 59,324 |

| | 100,146 |

| | 514,869 |

| | 674,339 |

| | ** |

| | Joseph M. Tucci | | 26,824 |

| | 1,564 |

| | 78,706 |

| | 107,094 |

| | ** |

| | Joseph M. Velli | | 16,157 |

| | 1,564 |

| | 55,706 |

| | 73,427 |

| | ** |

| | Named Executive Officers: | | | | | | | |

|

| | | | Martin Mucci | | 59,324 |

| | 100,146 |

| | 514,869 |

| | 674,339 |

| | ** |

| | Efrain Rivera | | 2,807 |

| | 19,767 |

| | 36,915 |

| | 59,489 |

| | ** |

| | Mark A. Bottini | | 3,067 |

| | 12,917 |

| | 27,553 |

| | 43,537 |

| | ** |

| | Michael E. Gioja | | 8,206 |

| | 26,233 |

| | 49,223 |

| | 83,662 |

| | ** |

| | Robert Morin | | — |

| | 6,529 |

| | 8,578 |

| | 15,107 |

| | ** |

| | All directors, NEOs, and executive officers of the Company as a group (17 persons) | | 38,427,850 |

| | 221,755 |

| | 1,210,791 |

| | 39,860,396 |

| | 10.9 | % |

** Indicates that percentage is less than 1%.

| | (1) | This column reflects shares held of record and Company shares owned through a bank, broker, or other holder of record. For executive officers, this also includes shares owned through the 401(k) Plan. |

| | (2) | This column includes restricted stock awards to independent directors and executive officers that have not yet vested. These non-vested restricted stock awards have voting and dividend rights, and thus are included in beneficial ownership. |

| | (3) | This column includes shares that may be acquired upon exercise of options, which are exercisable on or prior to September 29, 2013. Under SEC rules, shares that may be acquired within 60 days by exercise of options.are included in beneficial ownership. |

| | | (2)(4)

| | Included in shares beneficially owned for Mr. Golisano are 278,060278,068 shares owned by the B. Thomas Golisano Foundation, forof which Mr. Golisano is a member of the foundation’s six-member board of trustees. Mr. Golisano disclaims beneficial ownership of these shares. |

| | (3)(5)

| | Mr. Golisano has 11,430,2957,750,295 shares pledged as security. |

| | (4)(6)

| | Included in shares beneficially owned are shares held in the names of family members or other entities: Mr. Golisano — 71,33070,481 shares; and Mr. Inman — 136,949 shares. |

| | (5)(7)

| | Beneficial ownership information is based on information contained in the Form 13F filed with the SEC on May 13, 2011August 14, 2013 by Fidelity Management and Research Company (FMR LLC). |

| | (8) | Beneficial ownership information is based on information contained in the Form 13F filed with the SEC on August 14, 2013 by Capital World Investors. Capital World Investors, a division of Capital Research and |

4

| | | | | Management Company (“CRMC”), is deemed to be the beneficial owner of 29,638,71819,330,182 shares as a result of CRMC’sCRMC's acting as investment advisor to various investment companies registered under Section 8 of the Investment Company Act of 1940. | | (6) | | Included in shares beneficially owned are unvested restricted stock: Mr. Doody — 3,094 shares; Mr. Flaschen — 5,449 shares; Mr. Horsley — 1,652 shares; Mr. Inman — 5,449 shares; Ms. Joseph — 5,449 shares; Mr. Mucci — 52,558 shares; Mr. Tucci 5,449 shares; Mr. Velli — 5,449 shares; Mr. Morphy — 54,615 shares; Mr. Gioja — 12,714 shares; Mr. Kuchta — 17,310 shares; Mr. McCarthy — 18,042 shares; and all directors, NEOs, and executive officers as a group — 204,546 shares. | | (7) | | Included in shares beneficially owned are shares that may be acquired upon exercise of options, which are exercisable on or prior to September 29, 2011: Mr. Flaschen — 59,979 shares; Mr. Horsley — 47,084 shares; Mr. Inman — 59,979 shares; Ms. Joseph — 24,979 shares; Mr. Mucci — 238,367 shares; Mr. Tucci — 59,979 shares; Mr. Velli — 21,979 shares; Mr. Morphy — 176,338 shares; Mr. Gioja — 17,108 shares; Mr. Kuchta — 114,188 shares; Mr. McCarthy — 68,188 shares; and all directors, NEOs, and executive officers as a group — 901,525 shares. | | (8) | | Mr. McCarthy retired from the Company effective August 1, 2011 and, as a result, forfeited 18,042 shares of unvested restricted stock included in his beneficial ownership as of July 31, 2011. | | (9) | | Mr. Judge resigned from his position of President and Chief Executive Officer effective July 31, 2010. | | (10) | | Mr. Humenik resigned from his position of Senior Vice President of Sales and Marketing effective October 15, 2010. |

PROPOSAL 1 • lELECTION OF DIRECTORS FOR A ONE-YEAR TERM Stockholders annually elect directorsThe Board is elected by the stockholders to serve for one yearoversee the overall success of the Company, review its operational and until the directors’ successors have been electedfinancial capabilities, and qualified.periodically assess its long-term strategic objectives. The nine persons listed below, each of whom currentlyBoard serves as a director, have been nominatedthe ultimate decision-making body of the Company, except for electionthose matters reserved to stockholders. The Board selects and oversees the members of senior management, who are charged by the Board bywith conducting the Company’s Governance and Compensation Committee. Seven of the nine nominees are neither employees nor former employeesday-to-day business of the Company. If elected, each nominee will hold office untilThe Board acts as an advisor to senior management and ultimately monitors management’s performance.

Election Process The Company's By-Laws provide for the 2012 Annual Meetingannual election of Stockholders and until his or her successor is elected and has qualified. Although the Board believes that all of the nominees will be available to serve as a director, the persons named in the enclosed proxy may exercise discretionary authority to vote for substitute nominees proposed by the Board. Below we identify and describe the key experience, qualifications, and skills our directors bring to the Board that are important in light of our business and structure. Also included below are any public company directorships held during the past five years and directors’ periods of service to our Board. | | | | | | | | | | | | | | | | | Director

| | Position, Principal Occupation, Business

| Name | | Age | | Since | | Experience, Directorships, and Qualifications | | | B. Thomas Golisano | | | 69 | | | | 1979 | | | Mr. Golisano founded Paychex in 1971 and is Chairman of the Board of the Company. Until October 2004, he served as President and Chief Executive Officer of the Company. He serves on the board of trustees of the Rochester Institute of Technology. Mr. Golisano serves as a director of numerous non-profit organizations and private companies, and is founder and member of the board of trustees of the B. Thomas Golisano Foundation. He serves on our Executive Committee. Mr. Golisano has extensive executive experience as the founder and former Chief Executive Officer of Paychex, which provides him with in-depth knowledge of the operations of the Company and qualifies him to lead the Board. | Joseph G. Doody | | | 58 | | | | 2010 | | | Mr. Doody has served as President, North American Delivery of Staples, Inc., an office products company, since 1998. From 1974 to 1998, Mr. Doody held several managerial positions with Eastman Kodak Company, an imaging technology company, most recently serving as General Manager and Vice President, North America, Office Imaging. Mr. Doody serves as a director of Casella Waste Systems, Inc. and is a member of the Executive Advisory Committee for the Simon Graduate School of Business at the University of Rochester. He serves on our Audit Committee. Mr. Doody’s strong understanding of small- to medium-sized businesses through his experience at Staples, as demonstrated by growth within his organization, provides our Board with important operational insight. |

6

| | | | | | | | | | | | | | | | | Director

| | Position, Principal Occupation, Business

| Name | | Age | | Since | | Experience, Directorships, and Qualifications | | | David J. S. Flaschen | | | 55 | | | | 1999 | | | Mr. Flaschen is an investor and advisor to a number of private companies providing business, marketing, and information services. Most recently, he was a partner with Castanea Partners, a private equity investment firm, from 2005 to 2011. Mr. Flaschen is a director of various private companies. He is the Chairman of our Audit Committee and serves on our Investment Committee and Governance and Compensation Committee. Mr. Flaschen has extensive executive experience in information and marketing services. His financial expertise is a great benefit to the Board and Audit Committee, acquired through his education and his experience, including his role in assessing financial performance of other companies and in reviewing and understanding financial statements. | Phillip Horsley | | | 72 | | | | 2011 | | | Mr. Horsley is the founder of Horsley Bridge Partners, a leading manager of private equity investments for institutional investors, since 1982. Mr. Horsley was a director of the Company from 1982 to 2009, and is standing for re-election at the 2011 Annual Meeting. Mr. Horsley has a strong background in finance and business and has expertise in investment management. Mr. Horsley’s long-term relationship with the Company provides him with extensive knowledge of the Company’s history and operating environment. | Grant M. Inman | | | 69 | | | | 1983 | | | Mr. Inman is the founder and General Partner of Inman Investment Management, a private investment company formed in 1998. He is a director of Lam Research Corporation and several private companies. He was a director of Wind River Systems, Inc. until July 2009. Mr. Inman is a trustee of the University of California, Berkeley Foundation. He is the Chairman of our Investment Committee and serves on our Audit Committee and Governance and Compensation Committee. Mr. Inman has a strong background in finance, business, and entrepreneurial experience, and has expertise in investment management. Mr. Inman’s 28-year tenure on the Board provides him with extensive knowledge of the Company. | Pamela A. Joseph | | | 52 | | | | 2005 | | | Ms. Joseph is Vice Chairman of U.S. Bancorp Payment Services and Chairman of Elavon (formerly NOVA Information Systems, Inc.), a wholly owned subsidiary of U.S. Bancorp. U.S. Bancorp Payment Services and Elavon manage and facilitate payment processing. Ms. Joseph has been Vice Chairman of U.S. Bancorp since December 2004 and serves on its 14-member managing committee. She is a director of Centene Corporation. Ms. Joseph serves on our Audit Committee and our Executive Committee. She has extensive executive experience in the financial services industry, and brings a wealth of technology insight to the Board and Audit Committee. |

7

| | | | | | | | | | | | | | | | | Director

| | Position, Principal Occupation, Business

| Name | | Age | | Since | | Experience, Directorships, and Qualifications | | | Martin Mucci | | | 51 | | | | 2010 | | | Mr. Mucci has served as President and Chief Executive Officer of the Company since September 2010. Mr. Mucci joined the Company in 2002 as Senior Vice President, Operations. Prior to joining Paychex, he held senior level positions with Frontier Telephone of Rochester, a telecommunications company, during his 20-year career. Mr. Mucci is a director of Cbeyond, Inc. He is currently Chairman of the St. John Fisher College Board of Trustees, and also serves as the Chairman of the Catholic Family Center Board of Governors. He is Chairman of our Executive Committee. The Board selected Mr. Mucci to serve as a director as he provides day-to-day leadership as the current Chief Executive Officer of Paychex, giving him in-depth knowledge of the Company, its operations, and opportunities. | Joseph M. Tucci | | | 64 | | | | 2000 | | | Mr. Tucci has been the Chairman of the Board of Directors of EMC Corporation, the world leader in information infrastructure technology and solutions, since January 2006. He has been Chief Executive Officer and President of EMC Corporation since January 2001, and President since January 2000. Mr. Tucci is also Chairman of the Board of Directors of VMware, Inc. He is Chairman of our Governance and Compensation Committee. Mr. Tucci’s experience as Chief Executive Officer of EMC Corporation provides him with extensive executive management experience and knowledge of the challenges a company faces due to rapid changes in the marketplace. | Joseph M. Velli | | | 53 | | | | 2007 | | | Mr. Velli has been Chairman and Chief Executive Officer of BNY ConvergEx Group, LLC, a leading global agency brokerage and technology company offering a comprehensive suite of investment services, since October 2006. Prior to the formation of BNY ConvergEx Group, he was a Senior Executive Vice President of The Bank of New York since September 1998 and assumed the additional role of Chief Executive Officer of BNY Securities Group in October 2002. He is a director of E*Trade Financial Corporation. He serves on our Investment, Governance and Compensation, and Executive Committees. Mr Velli has extensive knowledge of the capital markets and plays a key role in the Board’s discussions of the Company’s investments and liquidity. |

Our by-lawsdirectors. The By-Laws provide that each director shall be elected by a majority of the votes cast for the director at any meeting for the election of directors at which a quorum is present. If a nominee that is an incumbent director does not receive a required majority of the votes cast, the director shall offer to tender his or her resignation to the Board. The Governance and Compensation Committee of the Board shall consider such offer and will make a recommendation to the Board on whether to accept or reject the resignation, or whether other action should be taken. The Board will consider the committee’s recommendation and will determine whether to accept such offer.

2013 Nominees for Director At the 2013 Annual Meeting, there are nine nominees for election as director, as listed on the following pages. Each of the nominees is a current member of the Board, having been elected by the stockholders at the 2012 Annual Meeting of Stockholders. The nine persons listed have been nominated for election to the Board by the Company’s Governance and Compensation Committee. The nominees, with the exception of Mr. Golisano and Mr. Mucci, are independent under both NASDAQ and SEC director independence standards. If elected, each nominee will hold office until the 2014 Annual Meeting of Stockholders and until his or her successor is elected and has qualified. We believe that all of the nominees will be available to serve as a director. However, if any nominee should become unable to serve, the persons named in the enclosed proxy may exercise discretionary authority to vote for substitute nominees proposed by the Board. The Board believes that the combination of the various qualifications, skills, and experience of the 2013 director nominees would contribute to an effective and well-functioning Board. We have provided biographical information on each of the nominees. Included within this information, we identify and describe the key experience, qualifications, and skills our directors bring to the Board that are important in light of our business and structure. The Board of Directors recommends the election of each of the nominees identified above.on the following pages. Unless otherwise directed, the persons named in the enclosed proxy will vote the proxy FOR the election of each of these nominees.

8

| | | | | B. Thomas Golisano | | | | Mr. Golisano founded Paychex in 1971 and is Chairman of the Board of the Company. Until October 2004, he served as President and Chief Executive Officer of the Company. He serves on the board of trustees of the Rochester Institute of Technology. Mr. Golisano serves as a director of numerous non-profit organizations and private companies, and is founder and member of the board of trustees of the B. Thomas Golisano Foundation. Mr. Golisano has extensive executive experience as the founder and former Chief Executive Officer of Paychex, which provides him with in-depth knowledge of the operations of the Company and qualifies him to lead the Board. | | Director Since: 1979 Age: 71 Board Committees: Executive Current Other Public Company Directorships: None | | | | | Joseph G. Doody | | | | Mr. Doody has served as President, North American Commercial of Staples, Inc., an office products company, since January 2013. From March 2002 to January 2013, he served as President, North American Delivery of Staples, Inc. Prior to that he served as President, Staples Contract and Commercial from when he first joined Staples in November 1998. From 1974 to 1998, Mr. Doody held several managerial positions with Eastman Kodak Company, an imaging technology company. Mr. Doody is a member of the Executive Advisory Committee for the Simon Graduate School of Business at the University of Rochester. Mr. Doody's significant leadership experience and management of a large division enables him to provide our Board with important operational insight and oversight. His deep knowledge of small- to medium-sized businesses derived from his experience as the head of the customer service operations at Staples brings thorough understanding of the risks and opportunities affecting our clients and potential clients. | | Director Since: 2010 Age: 61 Board Committees: Audit Current Other Public Company Directorships: Casella Waste Systems, Inc. | | | | | David J. S. Flaschen | | | | Mr. Flaschen is an investor and advisor to a number of private companies providing business, marketing, and information services. From 2005 through 2011, he was a partner with Castanea Partners, a private equity investment firm. Mr. Flaschen is a director of various private companies. Mr. Flaschen has extensive executive experience in information and marketing services. His financial expertise is a great benefit to the Board and its committees, acquired through his role in assessing financial performance of other companies and in reviewing and understanding financial statements. | | Director Since: 1999 Age: 57 Board Committees: Audit (Chairman), Investment, Governance and Compensation Current Other Public Company Directorships: None | | | | | Phillip Horsley | | | | Mr. Horsley is the founder of Horsley Bridge Partners, a leading manager of private equity investments for institutional clients. The firm was founded in 1983 and Mr Horsley retired in 2010. Mr. Horsley has a strong background in finance and business and has expertise in investment management. Mr. Horsley’s long-term relationship with the Company provides him with extensive knowledge of the Company’s history and operating environment. | | Director Since: 2011 (previously served from 1982-2009, reappointed in 2011) Age: 74 Board Committees: Investment and Goverance and Compensation Current Other Public Company Directorships: None | | | |

| | | | | Grant M. Inman | | | Mr. Inman is the founder and General Partner of Inman Investment Management, a private investment company formed in 1998. Mr. Inman is a trustee of the University of California, Berkeley Foundation and is also a director of several private companies. He was a director of Wind River Systems, Inc. until July 2009. Mr. Inman has a strong background in finance, business, and entrepreneurial experience, and has expertise in investment management. Additionally, Mr. Inman’s 30-year tenure on the Board provides him with extensive knowledge of the Company.

| | Director Since: 1983 Age: 71 Board Committees: Investment (Chairman), Audit,and Goverance and Compensation Current Other Public Company Directorships: Lam Research Corporation (Lead Independent Director) | | | | | Pamela A. Joseph | | | Ms. Joseph is Vice Chairman of U.S. Bancorp Payment Services and Chairman of Elavon (formerly NOVA Information Systems, Inc.), a wholly owned subsidiary of U.S. Bancorp. U.S. Bancorp Payment Services and Elavon manage and facilitate consumer and corporate card issuing, as well as payment processing. Ms. Joseph has been Vice Chairman of U.S. Bancorp since December 2004 and serves on its 14-member managing committee. She has extensive executive experience in the financial services industry, and brings a wealth of technology insight to the Board and its committees.

| | Director Since: 2005 Age 54 Board Committees: Audit and Executive Current Other Public Company Directorships: Centene Corporation | | | | | Martin Mucci | | | Mr. Mucci has served as President and Chief Executive Officer of the Company since September 2010. Mr. Mucci joined the Company in 2002 as Senior Vice President, Operations. Prior to joining Paychex, he held senior level positions with Frontier Telephone of Rochester, a telecommunications company, over the course of his 20-year career. He is a member of the Upstate New York Advisory Board of the Federal Reserve Bank of New York and the Board of Trustees for St. John Fisher College. The Board selected Mr. Mucci to serve as a director because he provides day-to-day leadership as the current Chief Executive Officer of Paychex, giving him intimate knowledge of the Company, its operations, and opportunities.

| | Director Since: 2010 Age: 53 Board Committees: Executive (Chairman) Current Other Public Company Directorships: Cbeyond, Inc. | | | | | Joseph M. Tucci | | | | Mr. Tucci has been the Chairman of the Board of Directors of EMC Corporation, the world leader in information infrastructure technology and solutions, since January 2006. He has been Chief Executive Officer of EMC Corporation since January 2001, and President from January 2000 to July 2012. Mr. Tucci’s experience as Chief Executive Officer of EMC Corporation provides him with extensive executive management experience and knowledge of the challenges a company faces due to rapid changes in the marketplace. | | Director Since: 2000 Age: 66 Board Committees: Governance and Compensation (Chairman) Current Other Public Company Directorships: EMC Corporation (Chairman of the Board) and VMware, Inc. (Chairman of the Board) | | | | | Joseph M. Velli | | | | Mr. Velli has been Chairman and Chief Executive Officer of BNY ConvergEx Group, LLC, a leading global agency brokerage and technology company offering a comprehensive suite of investment services, since October 2006. Prior to the formation of BNY ConvergEx Group, he was a Senior Executive Vice President of The Bank of New York since September 1998 and assumed the additional role of Chief Executive Officer of BNY Securities Group in October 2002. He is also a member of the E*Trade Bank board. Mr Velli has extensive knowledge of the capital markets and plays a key role in the Board’s discussions of the Company’s investments and liquidity. | | Director Since: 2007 Age: 55 Board Committees: Investment, Executive, and Governance and Compensation Current Other Public Company Directorships: E*Trade Financial Corporation |

DIRECTOR COMPENSATION

FOR THE FISCAL YEAR ENDED MAY 31, 20112013 Director compensation is set by the Governance and Compensation Committee and approved by the Board. The Board’s authority cannot be delegated to another party. The Company’s management does not play a role in setting Board compensation. The Company compensates the independent directors of the Board using a combination of cash and equity-based compensation. The Company’s management does not play a role in setting Board compensation. Martin Mucci, President and Chief Executive Officer (“CEO”) of the Company since September 2010, and Jonathan J. Judge, former President and CEO of the Company, received, receives no compensation for theirhis services as directors. Thedirector. Rather, the compensation received by Mr. Mucci and Mr. Judge in their roleshis role as President and CEO areis shown in the Fiscal 20112013 Summary Compensation Table, contained in the Named Executive Officer Compensation Sectionsection of this Proxy Statement. Cash CompensationThe table below presents the total compensation received from the Company by all directors for fiscal year ended May 31, 2013 ("fiscal 2013").

| | | | | | | | | | | | | | | | | | Name (a) | | Fees Earned or Paid in Cash ($) (b) | | Stock Awards ($) (c) | | Option Awards ($) (d) | | Total ($) | | B. Thomas Golisano | | $ | 237,500 |

| | $ | — |

| | $ | — |

| | $ | 237,500 |

| | Joseph G. Doody | | $ | 80,000 |

| | $ | 57,708 |

| | $ | 55,843 |

| | $ | 193,551 |

| | David J. S. Flaschen | | $ | 112,500 |

| | $ | 57,708 |

| | $ | 55,843 |

| | $ | 226,051 |

| | Phillip Horsley | | $ | 82,500 |

| | $ | 57,708 |

| | $ | 55,843 |

| | $ | 196,051 |

| | Grant M. Inman | | $ | 92,500 |

| | $ | 57,708 |

| | $ | 55,843 |

| | $ | 206,051 |

| | Pamela A. Joseph | | $ | 85,000 |

| | $ | 57,708 |

| | $ | 55,843 |

| | $ | 198,551 |

| | Joseph M. Tucci | | $ | 90,000 |

| | $ | 57,708 |

| | $ | 55,843 |

| | $ | 203,551 |

| | Joseph M. Velli | | $ | 87,500 |

| | $ | 57,708 |

| | $ | 55,843 |

| | $ | 201,051 |

|

Fees Earned or Paid in Cash (Column (b)) The amounts reported in the Fees Earned or Paid in Cash column reflect the annual cash compensation paid to the independent directors in effect for the during fiscal year ended May 31, 2011 (“fiscal 2011”) is as follows: | | | | | | Compensation Element | | Amount | | | | Annual cash retainer, applicable to all independent directors | | $ | 70,000 | | | Audit Committee member annual retainer | | $ | 10,000 | | | Governance and Compensation Committee member annual retainer | | $ | 7,500 | | | Investment Committee member annual retainer | | $ | 5,000 | | | Executive Committee member annual retainer | | $ | 5,000 | | | Audit Committee Chair annual retainer | | $ | 20,000 | | | Governance and Compensation Committee Chair annual retainer | | $ | 12,500 | |

The2013, whether or not such fees were deferred. Annual cash compensation componentfor independent directors is comprised solely of annual retainers, which are paid in quarterly installments. TheThese retainers are paid for participation on the Board with separate retainers for committee membership. In addition to their committee membership retainers, the chairs of the Audit Committee and Governance and Compensation Committee were included to provide compensationreceive retainers in recognition for those Board members who contribute additionaltheir time contributed in preparation for committee meetings. These amounts are in addition to member annual retainer amounts. Effective July 7, 2010,The annual retainers were increased toin effect for fiscal 2013 are as follows:

| | | | | | | Compensation Element | | Amount | | Annual cash retainer, applicable to all independent directors | | $ | 70,000 |

| | Audit Committee member annual retainer | | $ | 10,000 |

| | Governance and Compensation Committee member annual retainer | | $ | 7,500 |

| | Investment Committee member annual retainer | | $ | 5,000 |

| | Executive Committee member annual retainer | | $ | 5,000 |

| | Audit Committee Chair annual retainer | | $ | 20,000 |

| | Governance and Compensation Committee Chair annual retainer | | $ | 12,500 |

|

Board cash compensation for the levels noted above. The most significant change was in the annual retainer, increasing $25,000 to $70,000. independent directors remains unchanged for fiscal 2013. Mr. Golisano, who is not an independent director, receivedreceives an annual retainer of $200,000$250,000 for his services as Chairman of the Board, paid in quarterly installments. This reflectsannual retainer was increased from an increaseannual retainer of $60,000 effective July 7, 2010,$200,000 in conjunctionOctober 2012.

Equity Awards: Stock Awards (Column (c)) and Options Awards (Column (d)) The amounts reported in the Stock Awards and Option Awards columns reflect the grant-date fair value of restricted stock awards and option awards, respectively, granted to each director, and do not reflect whether the recipient has actually received a financial gain from these awards (such as a lapse in the restrictions on a restricted stock award or by exercising stock options). For fiscal 2013, the equity-based compensation structure for independent directors was based on a total value of approximately $115,000 per director, with approximately 50% awarded in the other increases to director cash compensation. The Chairman of the Board does not receive any other cash or equity-based compensation.

9

Equity-Based Compensation

Equity-based compensation consists of a blendform of stock options and 50% in the form of restricted stock. In July 2010, the restricted stock awards granted in July 2007 lapsed. For Messrs. Flaschen, Inman, and Tucci and Ms. Joseph, 1,334 shares lapsed resulting in a value of $34,244 each. For Mr. Velli, 2,001 shares lapsed resulting in a value of $51,366. In July 2010,2012, all independent directors Messrs. Flaschen, Inman, Tucci, and Velli and Ms. Joseph received an annual equity award under the Paychex, Inc. 2002 Stock Incentive Plan, as amended and restated October 13, 2010 (the “2002 Plan”) as follows:composed of the following:

| | | | | | | | | Restricted Stock Awards | | Option Awards | | | | Grant Date | | July 7, 2010 | | July 7, 2010 | | Exercise Price | | NA | | $26.02 | | Quantity | | 1,922 | | 7,686 | | Vesting Schedule | | On the third anniversary of the date of grant. | | One-third per annum over three years from the date of grant. | | Certain Restrictions | | Shares may not be sold during the director’s tenure as a member of the Board, except as necessary to satisfy tax obligations. | | | | Other | | Upon the discretion of the Board, unvested shares may be accelerated in whole or in part for certain events including, but not limited to, director retirement.(1) | | Unvested options outstanding upon the retirement of a Board member will be canceled. |

| | | | | | | | | Restricted Stock Awards | | Option Awards | | Grant Date | | July 12, 2012 | | July 12, 2012 | | Exercise Price | | NA | | $31.50 | | Quantity | | 1,832 | | 15,052 | Fair Value (1) | | $31.50 | | $3.71 | | Vesting Schedule | | On the first anniversary of the date of grant. | | On the first anniversary of the date of grant. | | Certain Restrictions | | Shares may not be sold during the director’s tenure as a member of the Board, except as necessary to satisfy tax obligations. | | | Other (2) | | Upon the discretion of the Board, unvested shares may be accelerated in whole or in part for certain events including, but not limited to, director retirement. | | Unvested options outstanding upon the retirement of a Board member will be canceled. |

| | (1) | The fair value of restricted stock awards is determined based on the closing price of the underlying common stock on the date of grant. The fair value of stock option awards is determined using a Black-Scholes option pricing model. The assumptions used in determining the fair value of $3.71 per share for these options were: risk-free rate of 0.8%; dividend yield of 4.3%; volatility factor of 0.24; and expected option term life of 5.5 years. |

| | (1)(2)

| | Retirement eligibility for this purpose begins at age 55 or older with ten years of service as a member of the Board. |

WithAs of May 31, 2013, each director had the July 2010 award, the equity-based compensation structure for independent directors was based on a total value of approximately $100,000 per director, with approximately 50% awarded in the form of stock options and 50% in the form of restricted stock. The total estimated value was reduced from a previous target of $120,000 with the increase to director annual retainers as noted previously under “Cash Compensation.” The quantity offollowing equity awards granted varies based on the estimated fair value as of the grant date.outstanding:

On October 13, 2010, Mr. Doody was granted 5,765 options to purchase common stock at an exercise price of $27.63 and 1,442 shares of restricted stock. The terms of these grants are similar to the equity awards granted in July 2010, with the exception that both awards vest fully on the first anniversary of the grant date. These awards were granted to Mr. Doody upon his appointment to the Board. The award quantities are based on a proration of 75% of the quantities awarded to directors in July 2010. | | | | | | | | | Director | | Restricted Stock Outstanding (Shares) | | Stock Options Outstanding (Shares) | | Joseph G. Doody | | 1,832 |

| | 32,285 |

| | David J. S. Flaschen | | 3,754 |

| | 78,706 |

| | Phillip Horsley | | 1,832 |

| | 26,520 |

| | Grant M. Inman | | 3,754 |

| | 78,706 |

| | Pamela A. Joseph | | 3,754 |

| | 58,706 |

| | Joseph M. Tucci | | 3,754 |

| | 88,706 |

| | Joseph M. Velli | | 3,754 |

| | 55,706 |

|

Subsequent Events In July 2011,2013, the Board granted each independent director 11,46812,156 options to purchase shares of the Company’s common stock at an exercise price of $31.63$38.89 per share and 1,6521,564 shares of restricted stock. The terms of these awards were similar to the equity awards granted in July 2010, with the exception that these awards vest on the first anniversary of the grant date.2012. The award quantities are based on an estimated total value of approximately $100,000. $115,000 per director. Deferred Compensation Plan We maintain a non-qualified and unfunded deferred compensation plan in which all independent directors are eligible to participate. Directors may elect to defer up to 100% of their Board cash compensation. Gains and losses are credited based on the participant’s selection of a variety of designated investment choices, which the participant may change at any time. We do not match any participant deferral or guarantee a certain rate of return. The interest rates earned on these investments are not above-market or preferential. Refer to the Non-Qualified Deferred Compensation table and discussion within the Named Executive Officer Compensation section of this Proxy Statement for a listing of investment funds available to participants and the annual rates of return on those funds. Mr. Flaschen defers 100% of his Board cashDuring fiscal 2013, no directors deferred compensation under thisthe plan. No other directors participate in the plan at this time.

10

Benefits We reimburse each director for expenses associated with attendance at Board and committee meetings. Stock Ownership Guidelines The Governance and Compensation Committee set a stock ownership guidelineguidelines for our independent directors with a value of four times his or her annual Board retainer, not including any committee retainers. TheIn July 2013, the stock ownership guideline was increased to five times the annual Board retainer. The ownership guidelines were established to provide long-term alignment with stockholders’ interests. The independent directors are expected to attain the ownership guideline within five years after the later of first becoming a director or the initial adoption of the guideline. Directors must hold underlying stock received through restricted stock awards until their service on the Board is complete, with the exception of those shares sold as necessary to satisfy tax obligations. For the purpose of achieving the ownership guideline, unvested restricted stock awarded to the directors is included. All independent directors are compliant with the stock ownership guidelines. Prohibition on Hedging or Speculating In Company Stock Directors must adhere to strict standards with regards to trading in the Company’sPaychex stock. They may not, among other things: speculatively trade in Paychex stock; short sell any securities of the Company; or buy or sell puts or calls on the Company’s securities.

CORPORATE GOVERNANCE

The Board recognizes the fundamental principle that good corporate governance is critical to organizational success and the protection of stockholder value. As such, the Board has adopted a set of Corporate Governance Guidelines as a statement of principles guiding the Board’s conduct. These principles are intended to be interpreted in the context of all applicable laws and the Company's Certificate of Incorporation, By-laws, and other governing documents. A copy of these guidelines can be found on our website at: http://investor.paychex.com/governance. Board Leadership Structure | | | | | • | speculatively trade in the Company’s stock; | | | • | short sell any securities of the Company; or | | | • | buy or sell puts or calls on the Company’s securities. |

11

Fiscal 2011 Director Compensation

The table below presents the total compensation received from the Company by all directors for fiscal 2011.Board’s current leadership structure is comprised of: | | | | | | | | | | | | | | | | | | | | | Fees Earned

| | | | | | | | | | or Paid in

| | Stock Awards

| | Option Awards

| | Total

| Name | | Cash ($)(1) | | ($)(2),(4) | | ($)(3),(4) | | ($) | | | | B. Thomas Golisano | | $ | 200,000 | | | $ | — | | | $ | — | | | $ | 200,000 | | Joseph G. Doody(5) | | $ | 40,000 | | | $ | 39,842 | | | $ | 21,227 | | | $ | 101,069 | | David J. S. Flaschen(6) | | $ | 112,500 | | | $ | 50,010 | | | $ | 30,541 | | | $ | 193,051 | | | Grant M. Inman | | $ | 92,500 | | | $ | 50,010 | | | $ | 30,541 | | | $ | 173,051 | | | Pamela A. Joseph | | $ | 82,500 | | | $ | 50,010 | | | $ | 30,541 | | | $ | 163,051 | | | Joseph M. Tucci | | $ | 90,000 | | | $ | 50,010 | | | $ | 30,541 | | | $ | 170,551 | | | Joseph M. Velli | | $ | 85,000 | | | $ | 50,010 | | | $ | 30,541 | | | $ | 165,551 | |

| | | (1) | | The amounts in this column are as described previously under “Cash Compensation.” | | (2) | | Except for Mr. Doody as discussed in note 5, the amounts in this column reflect the fair value of $26.02 per share for restricted stock awards granted on July 7, 2010, and do not reflect whether the recipient has actually realized a financial gain from these awards (such as a lapse in a restricted stock award). The fair value of restricted stock awards is determined based on the closing price of the underlying common stock on the date of grant. | | (3) | | Except for Mr. Doody as discussed in note 5, the amounts in this column reflect the fair value of $3.97 per option granted on July 7, 2010, as determined using a Black-Scholes option pricing model, and do not reflect whether the recipient has actually realized a financial gain from these awards (such as by exercising stock options). Refer to note 3 to the Fiscal 2011 Summary Compensation Table, contained in the Named Executive Officer Compensation section of this Proxy Statement, for the assumptions used in determining the fair value of these awards. | | (4) | | As of May 31, 2011, each director had unvested restricted stock outstanding as follows: Mr Doody — 1,442 shares; Mr. Flaschen — 5,672 shares; Mr. Inman — 5,672 shares; Ms. Joseph — 5,672 shares; Mr. Tucci— 5,672 shares; and Mr. Velli — 5,672 shares. As of May 31, 2011, each director had the following number of options outstanding: Mr. Doody — 5,765; Mr. Flaschen — 67,186; Mr. Inman — 67,186; Ms. Joseph — 32,186; Mr. Tucci — 67,186; and Mr. Velli — 29,186. | | (5) | | Mr. Doody was appointed to the Board in October 2010. On October 13, 2010, he was granted restricted stock awards with a fair value of $27.63 per share and stock options with a fair value of $3.68 per share. For the stock options, the fair value was determined using the following assumptions: risk-free interest rate of 1.2%; dividend yield of 4.3%; volatility factor of .25; and expected option term life of 5.0 years. | | (6) | | Mr. Flaschen defers 100% of his cash fees earned to our non-qualified and unfunded deferred compensation plan. |

12

PROPOSAL 2 • ADVISORY VOTE ON EXECUTIVE COMPENSATION

We are asking our stockholders to provide advisory approval for our NEO compensation, as described in the Compensation Discussion and Analysis (the “CD&A”) section and Named Executive Officer Compensation section of this Proxy Statement. This proposal, commonly known as a“say-on-pay” proposal, gives our stockholders an opportunity to express their views on the overall compensation of our NEOs and the philosophy, policies, and practices as described in this Proxy Statement. We encourage stockholders to read the sections of this Proxy Statement referenced, which provide detailed information on the Company’s compensation policies and practices, and overall compensation of our NEOs.

Our executive compensation programs are designed to attract, develop, motivate, and retain highly qualified NEOs, who are critical to our success. We believe in apay-for-performance approach to NEO compensation, and under our compensation programs, the NEOs are rewarded for the achievement of specific annual and longer-term strategic and financial goals of the Company. Some key aspects of our compensation programs are as follows:

| | | | • | NEO compensation is evaluated and determined by our Governance and Compensation Committee, which is comprised of all independent directors. This committee utilizes the services of an independent consultant to advise them on matters of executive compensation. | | | • | Our executive compensation program is designed to implement core compensation principles, including alignment with shareholder interests, long-term value creation, andpay-for-performance. This is done through a mix of fixed and variable compensation. In addition, a mix of annual and long-term incentive programs creates a balance between short-term and long-term focus, reducing risk in the compensation programs. | | | • | In fiscal 2011, the equity-based long-term incentive awards were changed to include a mix of option awards, time-vested restricted stock awards, and performance awards. The performance awards were added to drive longer-term financial goals anticipated to increase shareholder value. | | | • | The Governance and Compensation Committee used its discretion to award only time-vested restricted stock to certain officers nearing retirement, to encourage retention. | | | • | The Board approved achange-in-control plan for officers of the Company to secure their continued service and ensure optimization of stockholder value in the event of achange-in-control. The plan outlines standard severance arrangements for executives if involuntary termination occurs within twelve months of achange-in-control event. The value of the benefits under the plan are conservative relative to our Peer Group and the plan does not provide for taxgross-ups. |

In addition, we have compensation practices that ensure consistent leadership and decision-making, certain of which are intended to mitigate risk. These include:

| | | | • | Stock ownership guidelines for directors and executive officers. | | | • | A long-standing insider trading policy. | | | • | Equity-based compensation agreements contain certain non-compete and other forfeiture provisions that will allow the Company to cancel all or any outstanding portion of equity awards and recover the gross value of any vested restricted shares or profits from exercises of option awards. | | | • | Employment of all executive officers “at will.” |

The Governance and Compensation Committee and the Board believe that the policies, procedures, and amounts of compensation discussed here and described further in this Proxy Statement are effective in achieving the desired goals of aligning our executive compensation structure with the interests of our stockholders. To indicate approval of our executive compensation, a majority of the shares present in person or by proxy and entitled to vote at the Annual Meeting must be voted for the proposal.

Thissay-on-pay vote is advisory, and therefore is not binding on the Company, the Governance and Compensation Committee, or our Board. Our Board values the opinions of our stockholders and, to the extent that there is any significant vote against the NEO compensation as disclosed in this Proxy Statement, we will

13

consider our stockholders concerns and the Governance and Compensation Committee will evaluate whether actions are necessary to address these concerns.

The Board of Directors recommends a vote FOR the advisory vote approving the executive compensation, as disclosed in this Proxy Statement.

PROPOSAL 3 • ADVISORY VOTE ON THE FREQUENCY OF FUTURE ADVISORY VOTES ON EXECUTIVE COMPENSATION

In addition to the advisorysay-on-pay vote, we are seeking a stockholder advisory vote on the frequency of futuresay-on-pay votes, as provided in Proposal 2. Stockholders may indicate how often they would prefer asay-on-pay advisory vote to occur: every year, every two years, or every three years. In addition, stockholders may abstain from voting. The Dodd-Frank Wall Street Reform and Consumer Protection Act requires the Company to hold the advisory vote on the frequency ofsay-on-pay votes at least once every six years.

After careful consideration, our Board has determined that an annualsay-on-pay vote is the most appropriate for the Company at this time, and recommends that stockholders vote for the Company to hold annual advisory votes on executive compensation, as decisions on executive compensation are made annually. We believe that an annual advisorysay-on-pay vote allows us to obtain frequent and timely input from our stockholders regarding corporate governance and executive compensation philosophy, policies, and practices.

The option of one year, two years, or three years that receives the majority of votes cast will be the frequency for the advisorysay-on-pay vote that has been selected by the stockholders. However, as this is an advisory vote, it is not binding on the Company or the Board. The Board will take into account the opinion of our stockholders when determining which frequency for futuresay-on-pay votes is best suited to the Company.

The Board of Directors recommends a vote for a frequency of EVERY YEAR for which stockholders will have an opportunity to cast an advisory vote on the compensation of the Company’s NEOs as set forth in the Proxy Statement.

PROPOSAL 4 • RATIFICATION OF SELECTION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee has appointed the firm of Ernst & Young LLP as the Company’s independent accountants for the fiscal year ending May 31, 2012. Although action by stockholders in this matter is not required, the Audit Committee believes that it is appropriate to seek stockholder ratification of this appointment and to seriously consider stockholder opinion on this issue. If the stockholders do not ratify the appointment, the Audit Committee will review its future selection of the independent accountants, but may still retain them.

Representatives from Ernst & Young LLP, the Company’s independent accountants since 1983, will be present at the Annual Meeting, will be afforded the opportunity to make any statements they wish, and will be available to respond to appropriate questions from stockholders.

To ratify the appointment of Ernst & Young LLP, a majority of the shares present in person or by proxy and entitled to vote at the Annual Meeting must be voted for the proposal.

The Board of Directors recommends a vote FOR the proposal to ratify the appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm for the fiscal year ending May 31, 2012.

14

Fees For Professional Services

The following table shows the aggregate fees for professional services rendered for the Company by Ernst & Young LLP:

| | | | | | | | | | | | | Year Ended May 31, | | | | | 2011 | | | 2010 | | | | | Audit fees | | $ | 744,000 | | | $ | 737,000 | | | Audit-related fees | | | 49,000 | | | | 45,000 | | | All other fees | | | 65,000 | | | | — | | | | | | | | | | | | | Total fees | | $ | 858,000 | | | $ | 782,000 | | | | | | | | | | | |

Audit feesfor fiscal 2011 and for the fiscal year ended May 31, 2010 (“fiscal 2010”) were for professional services rendered for the audits of the Company’s annual consolidated financial statements, reviews of the financial statements included in the Company’s Quarterly Reports onForm 10-Q, audits of the effectiveness of internal control over financial reporting, and for statutory and regulatory filings.

Audit-related feesfor fiscal 2011 and fiscal 2010 were for employee benefit plan audits.

All other feesfor fiscal 2011 were for an information technology data security review. There were no tax or other non-audit-related services provided by the independent accountants for fiscal 2010.

Audit Committee Policy on Pre-Approval of Services of Independent Accountants

The Audit Committee’s policy is to pre-approve all audit and permissible non-audit services provided by the independent accountants. The Audit Committee pre-approved all such audit and audit-related services provided by the independent accountants during fiscal 2011 and fiscal 2010.

15

REPORT OF THE AUDIT COMMITTEE

The Audit Committee of the Board of Directors oversees the Company’s financial reporting process on behalfChairman of the Board and is composed entirely ofnon-independent director (Mr. Golisano);